Susan Kokinda reveals the real reasons behind the British Empire’s aggressive stance toward Russia.

It’s not about missiles or democracy, but a critical financial report from Washington that threatens the City of London’s economic control.

The 2025 FSOC report prioritizes people over financial parasites, marking a fundamental shift in U.S. economic strategy under Trump’s administration.

We also discuss the broader implications on U.S.-British relations, the National Security Strategy, and the strategic economic battles involving food security, big pharma, housing stability, and narco-trafficking.

Tune in to uncover the economic war underpinning global tensions and subscribe to Promethean Action for more insights.

Chapters

00:00 The Midweek Update - The ‘Boring’ Document That Terrifies the British Empire - December 17, 2025

01:53 How London’s Panic is Out In The Open, and Russia Knows It

04:54 New Economic Strategy: People, Not Bankers First

09:04 Phase One: War vs Cartels

Snapshots and Notes

(Notes are extractions from the video and transcript as well as links to various documents and our own notes)

Interesting headline in BBC…

In other words, MI6 is not in control - they are waiting to see what happens next, as they have no clue what is going to happen next.

Makes one think, what they are pretending not to know?…

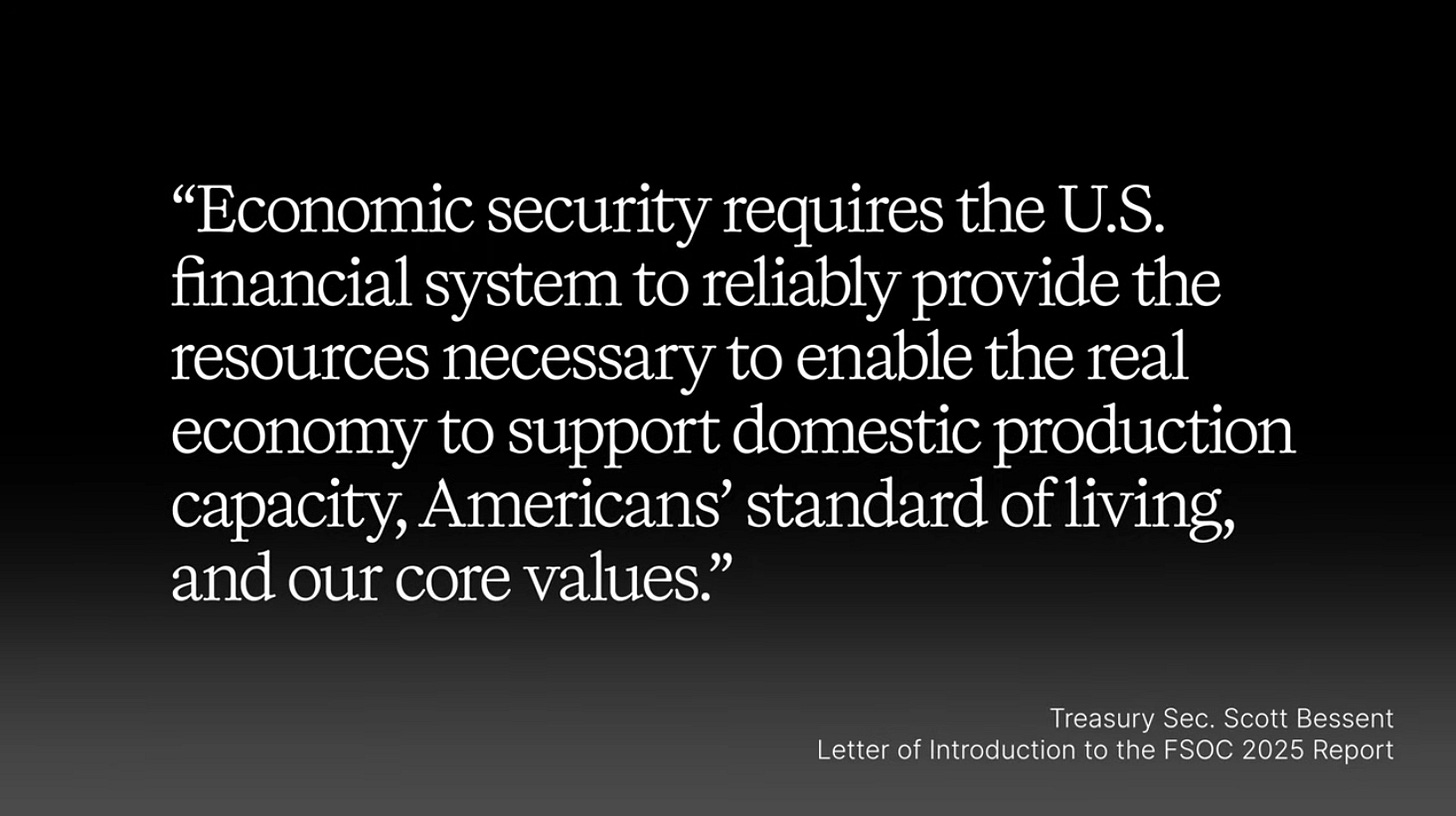

The Financial Stability Oversight Council's 2025 Annual Report (FSOC 2025) is causing a fit in the City of London as it undermines its financial mandates.

Instead, it sets up an economic model more suited to the building and production economy, and to the idea that people and economic growth come first, which is more aligned with what President Trump has already initiated.

(opens in our online library)

This is the economic equivalent of a declaration of war on the financier elite.

These two documents declare that from now on, people and economic growth come first, not financial parasites, and reassert that American principles will now govern us, not imperial principles.

(PDF opens in our online library)

How London’s Panic is Out In The Open, and Russia Knows It (01:53)

The preparation for war that the European Elites have been telling the media is a sign that they are nervous as well as prepared to defend their old ways.

Britain is being most overt…

Perhaps the most obvious impact on all of us will be the cost of building this resilience.

Sons and daughters, colleagues, veterans will all have a part to play, to build, to serve, and if necessary, to fight.

And more families will know what sacrifice for our nation means.

MI6 is stepping up to the microphone of desperation as well…

Meanwhile, in Russia…

WHY are the British Elite so desperate?

Financial control…

New Economic Strategy: People, Not Bankers First (04:54)

Economic security includes household incomes, which have gone unprotected for at least 50 years. President Trump is bringing that protection back.

Treasury Secretary Bessent uses simple words; however, their strokes are vast - the priority on household income replaces the priority on banks and financial institutions.

This goes against everything the British Empire has been building since the 1700s.

Remember the crash in 2008?

Who was deeply involved in the policy fights over the shape of the post-2008 crash world when Dodd-Frank1 was being shaped?

Lord Peter Mandelson, in his role as EU Trade Commissioner, and

Larry Summers, Obama’s National Economic Council Director

Mandelson and Summers were the key architects of Dodd-Frank, which protected the offshore British-controlled financial model.

Both have Epstein connections that led to their removal from their most recent positions.

And now the FSOC, the institution they created to protect their financial power, is being retooled to grow the real economy and protect American households.

Phase One: War vs Cartels (09:04)

Currently,

Food + healthcare + housing > Big Ags + Big Pharma + Big Finance = Cartels

All 3 of these industries MUST come under national security…

What will change all this ^^^??? T H I S vvv !!!

THAT is how pivotal both this and the NSS documents are for our future.

Big Ag Has Got to Go

The Big Beef cartel has a chokehold on your steak night. 🥩

Four big packers run the show.

President Trump is launching a DOJ probe and reviving real competition.

You should be yelling and accusing Cargill, JBS, Tyson, and National Beef for high meat prices - they are about to find out what the FO means in FAFO…

Big Pharma Has to Go

One of the things the president has said is that we have the weirdest health insurance system in the world, where we tax money from all these great Americans out here, and then we give boatloads of money to the insurance companies.

Why don’t we give that money to the American people and let them buy insurance that works for them and their families?

President trump has already been initiating the conversation on this and any time he does something like that he is already working on a plan to make it happen.

Big Finance Has to Go

BlackRock and foreign funds are buying up property in the U.S. - the home building companies need to start getting their act together, lest they soon go the way of BlackRock and foreign funds.

Drug Cartel

Besides the apparent effects caused by reducing and wiping out illegal drugs, the funds that typically go to the City of London from the drug cartels is going to dry up as well…

Beef, pharma, housing, and illegal drugs are the extraction and control mechanisms of the City of London - President Trump is returning them to their proper place as industries under national security coverage.

When you see the headlines about World War III,

don’t just look at the missiles, look at the money.

When you hear British spooks preparing the population for war,

understand what they’re really defending,

a centuries-old system of financial control that is dying.

The 2025 FSOC report is a declaration,

it says we’re done prioritizing your casinos over our people and

it partners with the National Security Strategy,

which declares that we’re done sacrificing

our manufacturing base to your free trade doctrine.

Trump isn’t just stopping a war in Ukraine,

he’s stopping the mechanism that creates those wars, and

he’s reviving the American system of builders, producers, and creators.

This is the economic war behind the shooting war, and it’s a war the British establishment cannot afford to lose because if they do, it’s game over.

The Dodd-Frank Act was signed into law in 2010 by President Obama in response to the 2008 financial crisis, aiming to prevent similar economic disasters. The legislation involved an extensive drafting, implementation, and ongoing adjustment process. It introduced new rules for the financial industry, requiring banks to maintain specific levels of cash and liquid assets to meet customer demand and limiting the riskiness of bank investments. This act was supported by lawmakers such as Chris Dodd and Barney Frank, after whom it is named. Fifteen years after its publication, the process of its implementation and dismantling is still underway.

Perspectives

Dodd-Frank Regulations are Detrimental

Dodd-Frank regulations are crushing community banks and credit unions, contributing to a significant decline in their numbers and recent bank closures.

The ‘one size fits all’ approach of Dodd-Frank does not work, as community banks and credit unions should not be regulated the same way as large, complex financial institutions.

Dodd-Frank is criticized as government overreach that exacerbates cronyism in the financial sector, similar to the Obamacare of the financial industry.

The way to reduce the power of banking lobbyists is to eliminate the government’s ability to pick winners and losers, rather than empowering the government further.

Dodd-Frank Regulations are Necessary

Dodd-Frank was enacted to impose stricter regulations on banks following the 2008 financial crisis, requiring them to maintain liquidity and pass stress tests to mitigate risks.

Major banks and their lobbyists have been fighting the implementation of Dodd-Frank for over a decade, particularly regarding capital requirements and executive compensation rules.

There is a need to ensure the provisions of Dodd-Frank are enforced to protect consumers from rising costs linked to corporate practices.

Despite the measures, concerns are raised about why lessons from past financial crises have not been fully learned or applied.